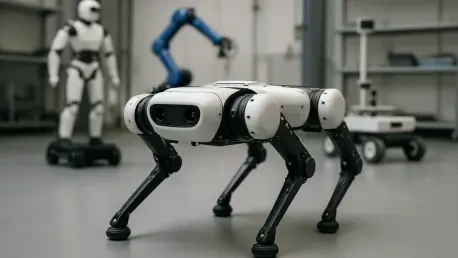

In an era where technology is rapidly reshaping industries, the convergence of artificial intelligence and physical systems stands out as a transformative frontier that promises groundbreaking advancements. Consider the staggering potential: robots that not only execute tasks but also think, adapt, and interact with the real world in real time, heralding a new age of automation. This is the promise of Physical AI, and SoftBank Group’s recent $5.4 billion acquisition of ABB Robotics has thrust this concept into the spotlight. This roundup gathers insights, opinions, and analyses from various industry perspectives to explore what this landmark deal means for the future of automation, the challenges ahead, and the broader implications for technological innovation. The goal is to provide a comprehensive view of how this strategic move could redefine the intersection of digital intelligence and tangible applications.

Diverse Perspectives on the Acquisition

Industry Leaders Weigh In on Strategic Vision

Across the tech and industrial sectors, many view SoftBank’s acquisition of ABB Robotics as a defining moment for Physical AI. Several corporate strategists emphasize the Japanese conglomerate’s ambition to integrate ABB’s expertise in precision manufacturing tools with cutting-edge AI capabilities. This fusion is seen as a potential game-changer, enabling smarter, more adaptive robotic systems that could revolutionize factory floors and beyond. The consensus among these leaders is that SoftBank is positioning itself as a pioneer in a field poised for explosive growth.

However, not all opinions are unanimously optimistic. Some business analysts caution that the $5.4 billion price tag carries significant financial risk, especially given the complexity of merging software-driven intelligence with hardware. They point out that while the vision is compelling, the practical execution of such a large-scale integration remains untested at this magnitude. This divergence in thought underscores the high stakes of the deal, with success hinging on SoftBank’s ability to navigate uncharted territory.

A third perspective comes from innovation consultants who highlight the cultural and operational challenges of blending two distinct corporate entities. They suggest that aligning ABB’s established industrial focus with SoftBank’s tech-forward mindset could prove more difficult than anticipated. Despite these concerns, there is a shared recognition that the deal represents a bold bet on the future, with the potential to set a new standard for how AI interacts with the physical world.

Financial Experts Analyze the Deal’s Viability

Turning to the financial realm, opinions vary on whether this acquisition will yield the expected returns. Many investment advisors note that ABB Robotics, with a reported revenue of $2.3 billion in the latest fiscal year, offers a solid foundation for growth. They argue that SoftBank’s deep pockets and history of transformative investments could amplify ABB’s market presence, especially if the integration unlocks innovative applications in industrial automation.

On the flip side, some economic analysts express skepticism about the timeline and cost of realizing Physical AI’s potential. With the deal expected to close between mid- and late-2026 pending regulatory approvals, there are concerns about delays and unforeseen expenses. These voices stress that the market may not wait for SoftBank to perfect its vision, especially with competitors already advancing in similar spaces.

A balanced take from financial commentators suggests that while the short-term risks are evident, the long-term payoff could be substantial if SoftBank leverages this acquisition to dominate an emerging sector. They advise stakeholders to monitor how the conglomerate manages initial hurdles, as early successes or failures could signal the deal’s ultimate impact on its portfolio. This spectrum of views paints a picture of cautious optimism tempered by pragmatic concerns.

Competitive Landscape and Global Trends

Insights on Physical AI as an Industry Shift

Industry observers across the globe are buzzing about Physical AI as the next big leap in technology, and SoftBank’s move is often cited as a catalyst. Many tech trend analysts argue that combining AI-driven software with physical robotics could transform sectors like manufacturing and logistics. They point to examples such as smarter robotic arms that learn from their environment, suggesting that such innovations could drastically improve efficiency and reduce costs.

Contrasting opinions emerge from regional market experts who note that while SoftBank is making strides, other players are not far behind. For instance, partnerships like Alibaba’s collaboration with Nvidia on humanoid robots in China are frequently mentioned as evidence of a fierce global race. These analysts warn that SoftBank must act swiftly to maintain a competitive edge, as delays in integration could cede ground to rivals with similar ambitions.

A further layer of insight comes from policy advisors who highlight the role of government support in shaping this trend. They reference SoftBank’s commitment to invest at least $100 billion in AI infrastructure in the U.S. through initiatives like the Stargate project, suggesting that such backing could give the company an advantage in certain markets. However, they also caution that regulatory landscapes vary widely, potentially complicating the rollout of Physical AI solutions on a global scale.

Challenges and Opportunities in Integration

Diving deeper into the operational side, technology integration specialists offer varied takes on merging ABB’s robotics with SoftBank’s AI prowess. Many stress the opportunity to redefine industry standards, envisioning a future where robots not only perform tasks but also anticipate needs through intelligent decision-making. This potential is seen as a major draw for investors and innovators alike, promising a new era of automation.

On the other hand, some engineering consultants raise red flags about the technical difficulties of such a merger. They argue that syncing complex AI algorithms with physical hardware is far from straightforward, often requiring years of testing and refinement. These challenges are compounded by the scale of ABB’s operations, which employ around 7,000 people in the robotics division, adding layers of logistical complexity to the equation.

A middle-ground perspective from project management experts suggests that while hurdles exist, they are not insurmountable with the right approach. They advocate for phased integration plans and robust change management strategies to bridge gaps between the two entities. This pragmatic advice reflects a broader sentiment that success will depend on meticulous planning and adaptability in the face of inevitable setbacks.

Key Takeaways from the Roundup

Reflecting on the myriad opinions gathered, it became clear that SoftBank’s acquisition of ABB Robotics had sparked intense debate across industries and regions. The consensus pointed to Physical AI as a transformative force, with the potential to reshape how technology interacts with the physical world, though skepticism lingered about the timeline and risks involved. Differing views on financial viability, competitive pressures, and integration challenges painted a nuanced picture of a deal that was as ambitious as it was uncertain.

A striking insight that emerged was the global nature of this race, with SoftBank’s moves juxtaposed against parallel efforts in markets like China. Analysts and consultants alike underscored the importance of speed and strategic alignment, while financial experts highlighted the need for patience amid regulatory and operational delays. This diversity of thought provided a well-rounded understanding of the stakes at play, revealing both the promise and the pitfalls of pioneering such an innovative field.

Looking ahead, actionable steps came to light for those inspired by this discussion. Industry players were encouraged to explore partnerships that bridge AI and hardware capabilities, while staying vigilant about regulatory shifts that could impact large-scale deals. For tech enthusiasts and business leaders, diving into further reading on Physical AI trends and monitoring SoftBank’s progress through 2025 to 2027 offered a way to stay informed. Ultimately, the conversation around this acquisition laid the groundwork for deeper exploration into how digital and physical innovation could converge to shape the future.