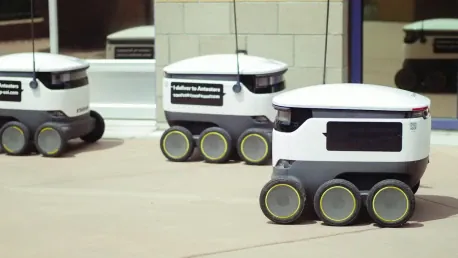

In an era where technology is advancing at an unprecedented pace, the investment landscape is also evolving to keep up with these developments, and the iShares Robotics and Automation ETF is at the forefront of this shift. This article delves into how this ETF offers investors a strategic way to capitalize on the revolutionary changes brought about by robots and automated systems across diverse sectors, including manufacturing, healthcare, transportation, and logistics.

The Growing Influence of Robotics and Automation

Robotics and automation are rapidly transforming operational efficiency and productivity across numerous industries. By investing in the iShares Robotics ETF, individuals have a unique opportunity to align with this trend toward smarter, automated systems. This ETF’s diversified portfolio encompasses companies that do not merely adopt automated solutions but are pioneers in innovation within this technological sphere.

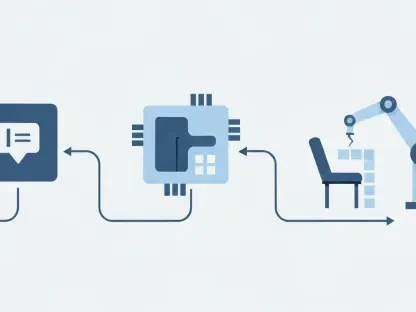

Automation is becoming a cornerstone in global industrial operations, making the iShares Robotics ETF an attractive prospect for investors eager to be part of this transition. The ETF provides broad exposure to the technological advancements that promise to reshape industries, offering a strategic entry point into this dynamic field. As industries progressively integrate automation, the potential for enhanced productivity and operational advancements is significant.

Promising Future Prospects

The promising future of the iShares Robotics ETF is underscored by analysts’ predictions of exponential growth in global demand for automation solutions. This anticipated market expansion positions the ETF to capitalize on this technological revolution effectively. Aligning with long-term investment strategies focused on sustainable and intelligent practices, the ETF represents a solid opportunity for those looking to invest in the future of automation.

A distinguishing feature of the iShares Robotics ETF is its targeted investment in companies leading technological change. This focus on innovation and industry leaders sets it apart from broader technology stocks, offering potentially higher returns through diversification across multiple growth avenues. This targeted approach mitigates risks often associated with single-sector investments, providing a more balanced and strategic investment option.

Potential Risks and Considerations

Despite its many advantages, the iShares Robotics ETF is not without potential risks. Market volatility, changes in regulations, and the rapid pace of technological advancements could pose challenges for investors. Therefore, it is crucial for individuals to conduct thorough research and stay informed about market trends and potential shifts that may impact the ETF’s performance.

Investors must navigate these challenges with careful consideration and due diligence. Staying updated with market conditions and regulatory changes, as well as understanding the technological landscape, are essential steps in managing risks associated with such investments.

Future Predictions and Growth

Looking ahead, the robotics sector is poised for significant expansion, which is expected to enhance the valuation and performance of ETFs like iShares Robotics. The increasing emphasis on sustainable technologies and eco-friendly innovations further supports this trend. As the global focus on sustainable development grows, companies within the ETF’s portfolio that prioritize these practices are likely to see substantial growth.

The future is bright for the iShares Robotics and Automation ETF, promising robust growth driven by technological advancements and sustainable innovations. This ETF provides a glimpse into the future of industrial transformation, where smart automation plays a crucial role in enhancing operational capabilities and efficiency.

Conclusion

In an age where technology is advancing at a breakneck speed, the investment world is also transforming to keep pace, and the iShares Robotics and Automation ETF stands at the leading edge of this evolution. This article explores how this ETF provides investors with a strategic opportunity to benefit from the groundbreaking changes driven by robotics and automated systems across various industries such as manufacturing, healthcare, transportation, and logistics. The proliferation of robotics technology is revolutionizing these sectors by increasing efficiency, reducing costs, and enhancing overall productivity. As robots and automation systems become increasingly integral to these industries, the iShares Robotics and Automation ETF allows investors to tap into this growth potential. By investing in companies that are at the cutting edge of robotics innovation, this ETF offers a diversified portfolio that aligns with the ongoing technological advancements. In doing so, it enables investors to capitalize on the transformative impacts that robots and automation continue to bring to the modern world.