The chip crisis caused by the disruption of global supply chains by the pandemic, as well as the robust demand generated by recovering economies, is expected to continue for some time. Companies such as Ford, VW, and Daimler are still dealing with the impact of the crisis, with executives warning that problems could continue for two or three years.

The Lifeblood of Modern Society

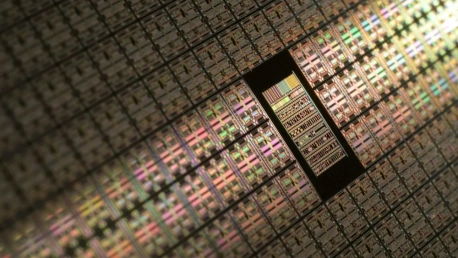

The chips, often called semiconductors, sometimes called microchips, function as the brains of our electronics. They are the lifeblood of modern society, but even before the pandemic, demand for them tended to exceed supply.

The global semiconductor industry has come to play a key role in the production of everything, from mobile phones to electric cars. The automotive sector suffered the heaviest blow, as all major global manufacturers were forced to suspend production.

VW CEO Herbert Diess, Daimler CEO Ola Kallenius, and Ford of Europe President Gunnar Herrmann told CNBC that it’s difficult to say when this complex situation will be resolved. Hermann estimates the crisis could last until 2024, exacerbated by the transition to electric cars. The semiconductor crisis could continue into 2022 and even 2023, the Daimler CEO predicted.

The CEO of IMI, the sixth-largest provider of electronics manufacturing services to the auto industry, expects the semiconductor shortage to persist for at least another year as demand from automakers and other manufacturers remains robust, and capacity expansion takes time, Bloomberg notes.

The duration of the crisis will also depend on the evolution of the pandemic and the imposition of new restrictions, the IMI CEO believes.

This is the case in Malaysia, for example. Malaysia-based semiconductor maker Unisem decided to shut down some factories for seven days after three employees died of coronavirus, dealing a further blow to the semiconductor supply chain, Bloomberg reports.

Unisem is one of several large Malaysian companies that assemble and test semiconductors for giants such as Infineon Technologies and STMicroelectronics.

Automakers Could Lose $210 billion in Revenue Due to Chip Shortage

Automakers could lose $210 billion in revenue this year due to supply chain disruptions and a global semiconductor shortage, nearly double the previous forecast of $110 billion, according to a report published Thursday by consulting firm AlixPartners, Reuters reports.

The chip shortage is only part of the problem. High prices and more difficult access to raw materials, such as steel and plastic resins, are driving up costs in the automotive sector and forcing car companies to cut production. In 2021, the crisis will affect the production of 7.7 million vehicles, warns AlixPartners.

In the US market, vehicle sales are slowing due to low inventories. “We originally forecast that things would return to normal in the fourth quarter of 2021. That’s not going to happen,” said Dan Hearsch, director at AlixPartners. He added that automakers will face difficulties until 2022 or early 2023.

Semiconductor shipments have been hit in recent months by the rise in COVID-19 cases in Malaysia, a major manufacturing hub. Problems at major U.S. ports have also hindered automakers’ efforts to import plastic and steel resins, Hearsch explained.

The shortfall has pointed to the need for automakers to be “proactive” right now and create a long-term “resilient supply chain” to avoid disruptions in the future, analysts say.

Stellantis Not Giving in to the Microchip Crisis

Even as the auto industry goes through an unprecedented crisis, automotive conglomerate Stellantis is putting electric cars ahead of combustion engine vehicles as consumers are increasingly attracted to this new type of vehicle.

“We will continue to manage all powertrains together, but electric vehicles come first,” Anne-Lise Richard, head of e-mobility at Stellantis, said in an interview in Milan. “We’re seeing more customers who are willing to buy electric vehicles now.”

Demand for electric vehicles has increased, particularly in Europe, where generous government incentives have made this type of vehicle more attractive than combustion engine models.

“This period of transformation is a wonderful opportunity to reset the clock and start a new journey,” said Stellantis CEO Carlos Tavares. “The group is at full speed on its electrification journey.”

The strategy will be underpinned by the construction of five battery factories in Europe and North America as the automaker prepares to gain as much capital as possible in this section of the automotive industry.

The chip supply shortage is the result of a combination of factors. Automakers closed their plants for several months during last year’s COVID-19 pandemic and canceled chip orders. At the same time, however, demand for chips from the electronics industry boomed, as people were forced to stay indoors, leading to increased sales of laptops and video game consoles. Now carmakers have to compete for chips with various manufacturers of electronics ranging from PlayStations to electrical toothbrushes.

Although opinions on when the shortage will end vary, most experts estimate that the shortage could last until mid-2023.