In a significant stride for the online grocery sector, Instacart has reported impressive results for the third quarter, highlighting notable year-over-year growth across several key metrics. These accomplishments include increases in total revenue, number of orders, gross transaction volume (GTV), and transaction revenue. Particularly, Instacart’s advertising and other revenues surged by 11% to $246 million, making up 3% of the total GTV. This strong performance was powered by elevated order volumes, higher average order values, and boosted advertising and transaction revenues. Demonstrating its financial robustness, Instacart achieved its fourth consecutive quarter of positive GAAP net income, with CFO Emily Reuter emphasizing the “strong profitability.”

Driving Forces Behind Growth

Integration with Retailers

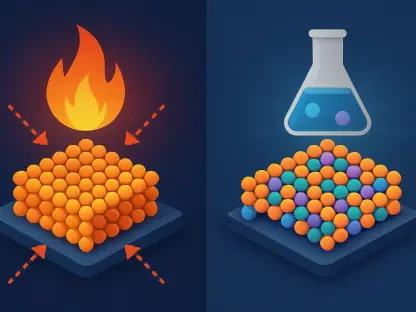

A critical factor behind Instacart’s success has been its deepening integration with retailers, a component of its business model that CEO Fidji Simo considers “under-appreciated.” The integration landscape was exemplified by the introduction of 150 features with Sprouts Farmers Market over an 18-month period. Such partnerships have been instrumental in shaping grocers’ perceptions of Instacart as a vital technological ally. Leveraging over a decade of specialized grocery data, Instacart has developed advanced AI capabilities that set it apart in the competitive market. These technological advancements have enabled it to create seamless integrations with grocers, thus enhancing operational efficiency and customer experience.

This symbiotic relationship means that retailers are increasingly relying on Instacart’s tech infrastructure to innovate and stay competitive. The adoption of these sophisticated tools has fortified their overall ecosystem, fostering an environment where both parties thrive. Such strategic alliances have not only bolstered Instacart’s financial metrics but also solidified its reputation as a frontrunner in the digital transformation of the grocery industry. CEO Fidji Simo’s commitment to deepening these partnerships is a testament to the long-term vision that aims to sustain growth in a nuanced and evolving market.

Omnichannel Solutions

Instacart continues to solidify its position as an omnichannel solutions provider, catering to both large and small e-commerce grocery orders. This strategy is integral to building and maintaining lasting customer habits, ensuring that a significant portion of customers’ grocery spending flows through Instacart. The company believes that fostering such habits is vital for both customer retention and economic viability. Despite branching out into other areas like retail media and in-store tech innovations such as smart carts, Instacart still sees considerable growth potential in the relatively under-penetrated online grocery shopping market.

One of the technological innovations driving this growth is the Caper Cart, which CEO Simo regards as a crucial growth opportunity. With 87% of the grocery industry still operating offline, there is immense potential for expansion through smart carts and other in-store technologies. Instacart has already announced several partnerships to deploy these carts, with plans for increased rollouts in 2025. These efforts underscore Instacart’s dedication to blending online and offline shopping experiences, thus creating a more cohesive and user-friendly shopping environment. Additionally, the company is continuously looking for ways to enhance these integrations, remaining at the forefront of technological advancement in the grocery sector.

Innovations and Expansions

New Ventures

The third quarter also marked a significant milestone for Instacart with the integration of restaurants into its platform. Since June, this has yielded “promising early results,” and Simo is optimistic about the potential growth that intertwining restaurant and grocery services could bring. This strategic move aligns with Instacart’s vision to diversify and expand its service offerings, thus tapping into new revenue streams. By incorporating restaurant deliveries, Instacart is not only broadening its customer base but also creating more value for existing users who can now enjoy a more comprehensive range of services from a single platform.

Another key area of innovation is Instacart’s advertising business, which is diversifying by increasing the variety of brand partners and ad placements. This diversification is crucial as it mitigates risks associated with dependency on major CPGs, some of which have reduced ad spending recently. Consequently, there has been a noticeable surge in demand from emerging brands eager to capitalize on Instacart’s robust advertising platform. By adopting this approach, Instacart is positioning itself as a versatile and adaptable player in the ever-evolving market landscape. This agility not only strengthens its current market position but also sets the stage for future growth amid changing industry dynamics.

Financial Performance and Future Prospects

In a significant development for the online grocery industry, Instacart has announced impressive third-quarter results, showcasing notable year-over-year growth across several key metrics. These achievements encompass increases in total revenue, the number of orders, gross transaction volume (GTV), and transaction revenue. Notably, Instacart’s advertising and other revenues jumped by 11%, reaching $246 million and accounting for 3% of the total GTV. This robust performance was driven by higher order volumes, increased average order values, and enhanced advertising and transaction revenues. Highlighting its financial strength, Instacart marked its fourth consecutive quarter of positive GAAP net income. Chief Financial Officer Emily Reuter emphasized the “strong profitability” of the company during this period, underpinning significant progress in a competitive market. These results reflect the growing consumer reliance on Instacart for their grocery needs and the company’s expanded market footprint.