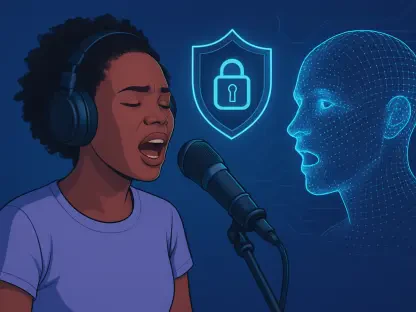

We’re joined today by technology expert Oscar Vail, who is at the forefront of tracking the strategies of major tech players. With Google’s YouTube Music recently beginning to place song lyrics behind a premium paywall, we’re diving into what this “experiment” means for users and the broader streaming landscape. This conversation will explore the strategic motivations behind this move, how it positions YouTube Music in a fiercely competitive market, the actual value of lyrics as a premium feature, and what this signals about Google’s overarching subscription ambitions.

Google has framed the move to limit free access to song lyrics as an “experiment.” What is the strategic goal of testing a paywall on a previously free feature, and how might this affect user loyalty and engagement for the ad-supported tier?

Calling this an “experiment” is a classic tech industry move to soften the blow of monetization while gathering crucial data. Google is testing the waters with a small fraction of its ad-supported users to measure the breaking point. The strategic goal is to identify just how essential the lyrics feature is and whether restricting it can effectively convert free users into paying subscribers. They are tracking how many times a user will hit that blurred, unscrollable lyrics screen before either giving up or pulling out their credit card. For some, after getting five free views, the frustration of seeing a card that says “Unlock lyrics with Premium” might be the final push. The risk, of course, is that it breeds resentment. Instead of upgrading, loyal free users might feel penalized and simply reduce their time on the app or start looking for alternatives.

With a U.S. market share behind Spotify and Apple Music, how does placing lyrics behind a paywall help YouTube Music compete? What are the risks of this strategy potentially driving free users to other services that still offer this feature?

It’s a very risky gambit, especially when you’re not the market leader. In the U.S., YouTube Music is in fourth place with a 7-9% market share, looking up at giants like Spotify and Apple Music. The strategy isn’t about attracting new users from competitors; it’s about squeezing more revenue from their existing user base. The hope is that by restricting a popular feature, a portion of their massive free audience, already embedded in the YouTube ecosystem, will decide to upgrade. The danger is immense. If a user’s primary desire is to sing along to their favorite tracks, and they suddenly can’t, they won’t hesitate to check if Spotify or another service still offers lyrics for free. This move could inadvertently serve as a marketing campaign for their rivals, pushing their own users away and making the climb from that distant fourth-place position even steeper.

A premium subscription at $10.99 a month includes ad-free listening, offline downloads, and AI tools like “Ask Music.” How significant are song lyrics as a conversion driver compared to these other features, and what user demographic is most likely to upgrade specifically for this?

When you look at the entire premium package for $10.99, lyrics feel like a smaller piece of a much larger puzzle. The core value drivers for most people are ad-free listening and offline downloads, which are universally desired. The new AI features, like asking Gemini to create a playlist for a specific “vibe,” are flashy and innovative, appealing to tech-savvy users. Lyrics, however, are a powerful emotional hook. They appeal to a very engaged user—someone who doesn’t just want background noise but wants to connect deeply with the music. This could be anyone from a teenager learning the words to a new pop song to someone rediscovering a classic. While probably not the number one reason for most people to subscribe, for this passionate segment, losing access to lyrics is a tangible, frustrating downgrade that could absolutely be the tipping point for them to finally pay up.

Alphabet now has over 325 million paid subscriptions across its services. How does this move to monetize lyrics on YouTube Music reflect Google’s larger consumer subscription strategy, and what does it signal about the future of free features on its other popular platforms?

This is a clear signal of Google’s broader strategic shift. With over 325 million paid subscriptions across services like Google One and YouTube Premium, the company is increasingly focused on generating reliable, recurring revenue directly from consumers, not just from advertising. They’ve seen that users are willing to pay for enhanced experiences. The YouTube Music paywall is a microcosm of this strategy: identify a heavily used free feature, quantify its importance to a dedicated user segment, and then monetize it. It signals that the era of everything being free on Google’s platforms, supported solely by ads, may be evolving. We could see similar “experiments” across their other products, where features that were once standard could be re-evaluated and potentially bundled into premium tiers to drive further subscription growth.

What is your forecast for the music streaming industry? Will we see more services placing once-standard free features, like lyrics or basic playback controls, behind premium paywalls in the coming years?

I believe this is absolutely the direction the industry is heading. The music streaming market is maturing, and the primary growth driver is no longer just attracting new users, but increasing the average revenue per user. As services look for new ways to differentiate and monetize, we will almost certainly see more features migrate from free to paid tiers. While core functionality like basic playback will likely remain free to keep a large user base for ad revenue, supplemental features like high-fidelity audio, advanced playlisting tools, and yes, lyrics, will increasingly become premium perks. It’s a delicate balancing act; companies will continuously test the limits of what users will tolerate for free versus what they are willing to pay for, creating a more fragmented and tiered user experience across the board.