In the dynamic and complex landscape of modern business, risk management has taken center stage. The KPMG “Future of Risk” report for early 2024 details how artificial intelligence (AI) and advanced technologies are fundamentally transforming risk management practices. As businesses grapple with a variety of evolving risks, AI emerges as a critical tool, poised to redefine how risks are identified, quantified, and mitigated.

Emergence of AI as a Core Risk Management Tool

The Rise of AI and Generative AI in Risk Management

Organizations are increasingly integrating AI and generative AI into their risk management frameworks. These technologies significantly streamline the process of identifying and quantifying risks, enabling quicker, more precise responses to potential threats. The ability to sift through vast amounts of data and generate actionable insights has made AI indispensable for modern risk professionals. An impressive 90% of survey respondents acknowledge AI’s crucial role in transforming risk management.

The implementation of AI in risk management systems allows organizations to develop a proactive stance towards risk. AI algorithms can analyze historical data, predict emerging threats, and offer mitigation strategies in a fraction of the time it would take human analysts. This capability is particularly valuable in areas such as financial forecasting, cybersecurity, and compliance, where the rapid identification of risks can prevent substantial losses. Furthermore, the rise of generative AI, which can create new data points and scenarios, adds another layer of sophistication, allowing companies to simulate various risk environments and plan accordingly.

Enhancing Analytical Capabilities and Response Time

Businesses can now harness AI to enhance their analytical capabilities. AI-driven solutions facilitate the rapid analysis of large datasets, helping firms discern trends and foresee risks that were previously undetectable. This technological pivot not only improves the efficiency of risk management processes but also accelerates response times, allowing organizations to address threats more proactively. As firms continue to adopt these tools, AI’s role in risk management is set to expand even further.

By leveraging machine learning and natural language processing, AI systems can monitor real-time data feeds, identify anomalies, and generate reports that highlight potential vulnerabilities. This continuous monitoring and instant feedback loop mean that organizations can respond to threats almost instantaneously, reducing downtime and mitigating damage. Companies that invest in these advanced analytical tools gain a significant competitive edge, as they can operate with greater confidence knowing they have a robust risk management system in place.

Investment Surge in AI-Driven Solutions

Escalating Budgets for Technological Solutions

The KPMG survey highlights a significant rise in investment toward AI-centric solutions. In the upcoming year, approximately 41% of respondents plan to allocate over half of their risk management budgets to technology, a notable increase from 28% the previous year. This surge underscores a strategic shift as companies recognize the need for advanced technology to enhance risk management practices, improve efficiency, and achieve cost reductions through accurate risk assessments.

This trend indicates a broader acceptance of AI as not just an auxiliary tool but a core element of corporate strategy. Companies are beginning to view technology investments as essential expenditures that yield significant returns in the form of improved risk mitigation and operational efficiency. The upward trajectory of this investment not only reflects the growing confidence in AI-driven solutions but also a commitment to staying ahead of emerging threats and maintaining a resilient organizational framework.

Technology as a Strategic Imperative

Given the complex risk environment, executives are making deliberate choices to invest heavily in technology. AI-driven solutions are becoming integral to risk management strategies, providing crucial support in navigating uncertainties and potential threats. This trend signifies more than just a budgetary adjustment; it reflects a fundamental change in how risk management is perceived and executed in the digital age.

Moreover, the increased investments indicate that businesses are aligning their risk management practices with broader digital transformation initiatives. By integrating AI solutions, companies can harmonize their IT infrastructure, streamline operations, and foster a culture of innovation that prioritizes proactive risk management. This strategic imperative ensures that organizations are not just reactive but can anticipate and mitigate risks in an increasingly uncertain global environment.

Digital Acceleration and Transformation

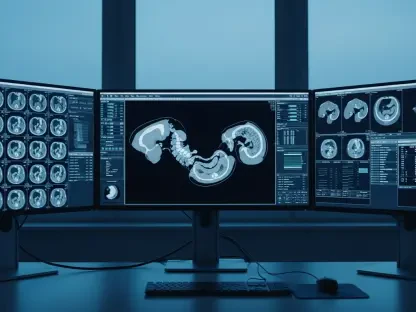

Impact on Risk Identification and Monitoring

Digital acceleration has proven transformative for risk management, particularly in risk identification, monitoring, and mitigation. Nearly all executives (98%) acknowledge that the digital shift has greatly enhanced their risk management approaches. This digital transformation is not just about adopting new tools but about rethinking traditional paradigms to create more responsive, data-driven risk management practices.

The adoption of digital technologies facilitates real-time risk identification, which is critical in an environment where threats can evolve rapidly. Digital tools can aggregate data from various sources, offering a comprehensive view of potential risks. These insights enable firms to implement timely mitigation strategies, thereby averting crises before they escalate. This real-time capability is a game-changer, allowing businesses to stay ahead of threats and protect their assets more effectively.

Creating Data-Driven Decision-Making Environments

With digital tools at their disposal, organizations can now establish environments conducive to data-driven decision-making. These tools help integrate and analyze data more efficiently, providing a clearer picture of potential risks and helping businesses develop more effective mitigation strategies. This shift towards data-centric methodologies is redefining how risk is managed across various sectors.

By leveraging big data analytics, firms can unearth patterns and correlations that were previously overlooked. These insights lead to better-informed decisions, as managers can draw from a broader, more accurate dataset. Consequently, this enhanced decision-making framework enables organizations to respond to risks with greater precision and confidence. As data-driven environments become the norm, companies can expect to see a substantial improvement in their risk management outcomes.

Collaboration and Integration

Benefits of Integrated Risk Management Systems

Integrated risk management systems are essential for cohesive and effective risk management strategies. About 68% of respondents from the KPMG survey advocate that such systems enhance decision-making efficacy. These systems integrate various risk domains and processes, creating a unified approach to managing risks across the organization, ultimately leading to better strategy alignment and stronger risk mitigation frameworks.

These integrated systems act as a centralized hub for risk-related information, allowing different departments to access and share data seamlessly. This interconnectedness fosters collaboration, as teams can coordinate their efforts more effectively. Moreover, integrated systems provide a holistic view of the organization’s risk landscape, enabling decision-makers to prioritize actions based on comprehensive insights. The result is a more agile and resilient risk management strategy.

Overcoming Challenges in Collaboration

Despite the potential benefits, challenges remain in achieving optimal collaboration levels between different risk domains. Around 46% of respondents feel current collaboration efforts are lacking, indicating an area ripe for improvement. Addressing these challenges is crucial for leveraging the full potential of integrated systems and improving organizational resiliency against risks.

To overcome these hurdles, companies need to foster a culture of collaboration that encourages open communication and resource sharing. This can be achieved through regular cross-functional meetings, integrated project management tools, and training programs that emphasize the importance of teamwork in risk management. By breaking down silos and encouraging a more collaborative approach, organizations can enhance their overall risk posture and ensure that all departments are aligned in their risk mitigation efforts.

Workforce Development and Training

Building a ‘Risk-Centric’ Workforce

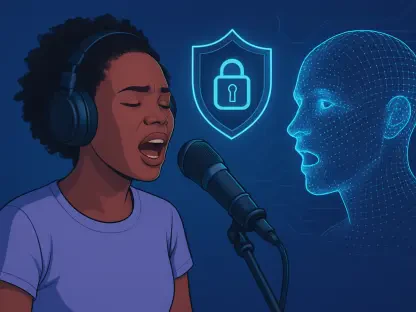

The increasing reliance on AI and digital tools necessitates a workforce proficient in these technologies. Developing teams skilled in IT risk, predictive modeling, and cybersecurity is critical over the next three to five years. Organizations must focus on creating new roles, upskilling current employees, and aligning workforce capabilities with AI-driven risk strategies to maintain a competitive edge in risk management.

This focus on workforce development ensures that employees are not only aware of the latest technological advancements but are also capable of leveraging these tools effectively. Training programs tailored to different risk domains can help employees understand how to incorporate AI tools into their daily workflows. This alignment between human expertise and technological capability is vital for creating a resilient and responsive risk management framework.

Aligning Skills with Technological Advancements

Training and workforce development are paramount as technology continues to evolve. Businesses must ensure that their employees are equipped with the necessary skills to effectively use AI-driven tools and methodologies. This alignment between skills and technology not only enhances the organization’s risk management capabilities but also fosters a culture of continuous improvement and adaptability.

Continuous learning and professional development programs can help employees stay updated with the latest advancements in AI and risk management practices. By encouraging a mindset of lifelong learning, organizations can ensure that their workforce remains agile and capable of adapting to new challenges. This investment in human capital complements technological investments, creating a synergistic effect that strengthens the overall risk management strategy.

Enhancing Data Governance

Importance of Unified Data Architecture

Effective implementation of AI and advanced technologies hinges on robust data governance and a unified data architecture. Ensuring that data is not fragmented and is easily accessible is critical for generating comprehensive risk insights. Organizations must focus on creating cohesive data architectures that enable seamless integration and utilization of AI technologies within risk management frameworks.

A unified data architecture acts as the backbone of any effective risk management system. It ensures that data from various sources is harmonized, making it easier to analyze and derive actionable insights. This cohesive structure prevents data silos, which can obscure critical risk information and hinder decision-making. By establishing a unified data architecture, organizations can maximize the efficacy of their AI-driven risk management tools and ensure a more comprehensive risk assessment.

Addressing Data Fragmentation Challenges

In today’s ever-changing and complex business environment, risk management has become a focal point. The KPMG “Future of Risk” report for early 2024 explains how artificial intelligence (AI) and advanced technologies are revolutionizing risk management techniques. As companies face a plethora of emerging risks, AI is becoming a cornerstone, set to transform the processes of identifying, measuring, and mitigating risks.

According to the report, AI’s capability to analyze vast amounts of data in real time allows businesses to foresee potential issues before they escalate into major problems. This proactive approach not only streamlines decision-making but also enhances the accuracy of risk assessments. Additionally, AI-driven models can simulate various scenarios, helping organizations prepare for a range of potential future threats. By automating routine tasks, AI also frees up human resources to focus on strategic planning and innovation.

Moreover, the integration of AI into risk management systems creates a more agile and responsive environment. This is essential in a world where risks are not only more complex but also more interconnected. As businesses continue to adapt to these changes, the utilization of advanced technologies like AI will be crucial in maintaining a competitive edge and ensuring long-term sustainability.