A catastrophic security failure at a key financial services vendor has potentially exposed the highly sensitive personal and banking information of over 400,000 individuals across the United States. Marquis, a company providing services to more than 700 banks and credit unions, confirmed a major data breach after hackers exploited a known vulnerability in its network infrastructure. The stolen data includes Social Security numbers, bank account details, and other personal identifiers, creating a significant and lasting risk of identity theft and financial fraud for a vast number of consumers. Cybersecurity researchers have linked the sophisticated attack to the notorious Akira ransomware gang, known for targeting organizations with unpatched security flaws.

1. How a Single Flaw Exposed Hundreds of Thousands

The infiltration of Marquis’ systems was traced back to a single, critical point of failure: an unpatched SonicWall firewall vulnerability that provided a direct entry point for malicious actors. On August 14, hackers leveraged this known flaw to bypass the company’s perimeter defenses and gain deep access to its internal networks. As a third-party service provider, Marquis centralizes sensitive consumer data from hundreds of financial institutions, making it a high-value target for cybercriminals. The breach underscores a growing concern in the cybersecurity landscape, where the interconnectedness of financial services means a vulnerability at one vendor can have a devastating ripple effect, compromising the data of customers from numerous otherwise secure banks and credit unions. This incident serves as a stark illustration of how attackers often seek the path of least resistance, targeting supply chain partners to circumvent the robust defenses of primary financial institutions. The successful exploit by the Akira ransomware group highlighted the severe consequences of delayed security updates.

Following the initial intrusion, the full scope of the breach began to emerge through a series of legally mandated disclosures filed in multiple states, including Texas, Maine, Iowa, Massachusetts, and New Hampshire. The Texas Attorney General’s Office alone confirmed that over 354,000 residents of the state were impacted, with the total number of victims nationwide expected to climb as more partner institutions complete their notifications. In a public statement, Marquis acknowledged the ransomware attack, reporting that it had “immediately enacted response protocols” and taken compromised systems offline upon detection. However, while the company stated there was “no evidence of identity theft or fraud” resulting from the incident, cybersecurity experts strongly cautioned against such assurances. The data stolen—names, birth dates, addresses, Social Security numbers, and banking credentials—represents the core components of an individual’s financial identity, making it a powerful tool for criminals long after the initial breach has been contained.

2. The Persistent Danger of Immutable Data

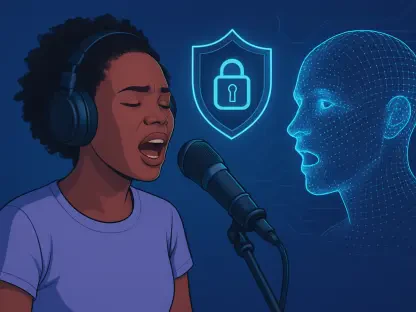

Unlike breaches involving passwords or credit card numbers, which can be changed and reissued, the theft of core identity data creates a permanent and irreversible threat. Ricardo Amper, CEO of Incode Technologies, emphasized this critical distinction, explaining that foundational data is static. An individual cannot meaningfully alter their date of birth or Social Security number, and once this information is exposed, it can be bought, sold, and traded on criminal marketplaces for years or even decades. The exposure of such immutable data is not merely a “moment in time” but an event whose consequences can “follow people for the rest of their financial lives.” This longevity transforms stolen personal information into a persistent asset for cybercriminals, who can store it and weaponize it long after public attention has moved on. The value of this data does not diminish over time; instead, it becomes a foundational element for increasingly sophisticated and damaging forms of fraud that are much harder to detect and resolve than a simple unauthorized transaction.

The danger posed by this breach is amplified by the evolution of modern identity fraud, which has moved far beyond simple impersonation. Criminals now leverage stolen core data to execute complex schemes, including account takeovers, where they use personal information to bypass security questions and seize control of existing financial accounts. Furthermore, they engage in new account fraud by opening credit cards, loans, and other lines of credit in a victim’s name. Perhaps the most insidious threat is synthetic identity fraud, one of the fastest-growing financial crimes. In this scenario, fraudsters combine a legitimate Social Security number with fabricated details, such as a different name and address, to create a new, “synthetic” identity. This false identity can be used to build a credit history over months or years, making it incredibly difficult for both victims and financial institutions to detect until significant financial damage has already occurred. The stolen Marquis data provides the perfect raw material for these advanced, long-term criminal enterprises.

3. Pathways to Protection and Compensation

In the wake of this extensive breach, experts stressed the importance of proactive measures for all individuals who were potentially affected. The recommended first line of defense included placing a credit freeze with the three major credit bureaus—Equifax, Experian, and TransUnion—which restricts access to one’s credit report and makes it significantly harder for criminals to open new accounts. Additionally, consumers were advised to enable real-time transaction alerts on all their financial accounts and to set up fraud alerts with the credit bureaus for an extra layer of monitoring. Another critical step involved securing government accounts that are often targeted by identity thieves, such as those with the Internal Revenue Service and the Social Security Administration, to prevent fraudulent tax filings or the theft of benefits. The incident underscored that relying solely on institutional protection was no longer sufficient; personal vigilance and the use of available security tools had become essential for mitigating the fallout from large-scale data compromises. This breach served as a powerful reminder that the consequences of corporate security lapses often fell directly on the shoulders of individual consumers, who then had to navigate a complex and often frustrating process to protect their financial lives. The legal landscape also began to shift, as attorneys started to encourage victims to come forward and explore their options for recourse through class action lawsuits aimed at seeking compensation for the loss of privacy, out-of-pocket expenses, and the considerable time spent managing the repercussions of the breach.