Blockchain and cryptocurrency have emerged as pivotal innovations in our digital era, profoundly transforming various sectors by enhancing security, transparency, and decentralization. As the technology matures, these advancements will likely become integral to the digital economy. Understanding the foundational concepts of blockchain and cryptocurrency is crucial to fully appreciate their transformative potential. The decentralized nature of blockchain means that no single entity controls the entire network, which enhances security and reduces the risk of fraud. Cryptocurrencies leverage this technology to offer a new form of digital money that operates independently of traditional financial institutions. This independence is one of the key factors driving the growing interest and adoption of cryptocurrencies worldwide.

Understanding Blockchain and Cryptocurrency

Blockchain is a decentralized ledger that records transactions across a network of computers, with each block containing a list of transactions and these blocks linking together in a chain. This design ensures the data’s transparency, immutability, and security. The decentralized nature of blockchain means that no single entity controls the entire network, which enhances security and reduces the risk of fraud. Cryptocurrencies leverage this technology to offer a new form of digital money that operates independently of traditional financial institutions. This independence is one of the key factors driving the growing interest and adoption of cryptocurrencies worldwide.

Cryptocurrency serves as digital or virtual currency secured by cryptography, with Bitcoin being the first and most famous example that emerged in 2009. Since then, thousands of cryptocurrencies have been developed, each with unique applications and features. These digital currencies use cryptographic techniques to secure transactions and control the creation of new units, ensuring the integrity and security of the financial ecosystem. The decentralized and cryptographic nature of cryptocurrencies also helps in reducing the incidence of fraud and providing a high level of security to online transactions and personal financial data.

Transformative Applications of Blockchain Technology

Financial Services and Banking

The financial sector was among the first to harness blockchain’s potential. Blockchain technology can streamline processes, reduce transaction costs, and increase security. Cross-border payments stand to benefit significantly, transitioning from several days of processing to near-instant transactions. Blockchain’s transparency also aids in reducing fraud and errors while providing a reliable transaction record. With innovations like smart contracts, which execute terms written into code without intermediaries, the industry sees reduced time and costs in complex transactions.

Smart contracts are particularly transformative, as they automate and enforce agreements without the need for intermediaries, reducing the potential for disputes and errors. This automation can significantly lower operational costs and increase efficiency, making financial services more accessible and affordable. Moreover, banks and financial services can implement blockchain to improve the robustness of services such as loans, insurance, and securities trading while minimizing risk and maximizing reliability.

Supply Chain Management

Blockchain can enhance transparency and traceability in supply chain management. Current supply chains are often cumbersome and lack visibility, leading to inefficiencies and risks like counterfeit goods. Blockchain offers an immutable record of each supply chain step, enabling companies and consumers to verify product authenticity. For example, Walmart and IBM’s blockchain system for food tracking can quickly trace contamination sources, mitigating foodborne illness risks. The ability to track products from their origin to the final consumer ensures that all parties involved in the supply chain can verify the authenticity and quality of goods. This transparency not only reduces the risk of fraud but also builds consumer trust and enhances brand reputation.

Blockchain provides manufacturers, suppliers, and consumers with real-time access to verified and detailed information about a product’s journey through the supply chain. This can significantly reduce inefficiencies, enhance operational processes, and bolster confidence in the markets. By implementing blockchain solutions, supply chain management becomes more efficient, reducing delays and mitigating risks while enhancing accountability and reinforcing stringent quality control measures.

Healthcare

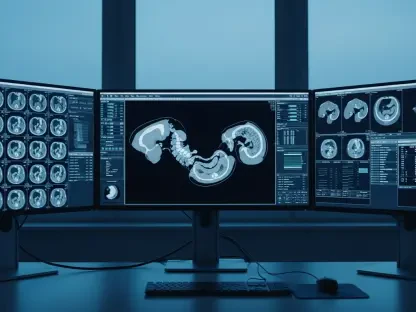

In healthcare, blockchain secures patient data and promotes interoperability between medical systems. Fragmented patient records across different providers make accessing complete medical histories challenging. With blockchain, secure patient data sharing is possible while maintaining privacy. Blockchain can also curb prescription fraud and streamline medical supply chain management by tracking drug transactions from manufacturers to patients. Blockchain’s ability to provide a single, immutable record of patient data ensures that healthcare providers have access to accurate and up-to-date information, improving patient care and outcomes.

This technology also enhances data security, reducing the risk of breaches and unauthorized access. Since trust, transparency, and security are paramount in healthcare, blockchain can facilitate seamless sharing of medical records among doctors, hospitals, insurers, and laboratories, leading to timely and well-informed medical decisions. Furthermore, blockchain implementations in healthcare can enhance research processes by ensuring the accuracy of clinical trial data and promoting data integrity and confidentiality.

Digital Identity Verification

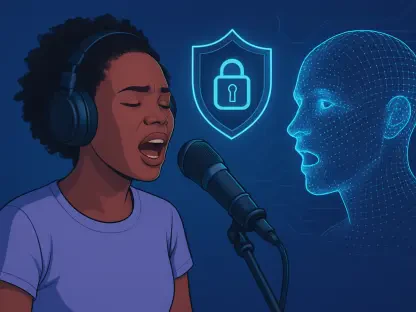

Blockchain technology is transforming digital identity verification systems, making them more secure against hacks and breaches. Traditional systems are centralized and vulnerable, but blockchain’s decentralized approach offers a safer alternative. Microsoft’s decentralized identity project exemplifies this, providing users full control over their data and reducing identity theft risks. By decentralizing identity verification, blockchain ensures that individuals have control over their personal information, reducing the risk of identity theft and fraud.

This approach also simplifies the verification process, making it more efficient and user-friendly. Users can create a self-sovereign identity that simplifies secure access to online services while preserving privacy. Decentralized identity solutions ensure that personal information is not stored in a single repository that could be targeted by hackers, thus significantly reducing exposure to cybersecurity risks. Additionally, individuals can selectively reveal or share personal information without compromising overall personal data security.

Voting Systems

Blockchain can revolutionize voting by ensuring transparent, tamper-proof platforms for elections. Traditional voting methods are prone to fraud and manipulation, posing election integrity concerns. Blockchain’s immutability guarantees accurate recording and safeguarding of votes, preventing alterations. Countries like Estonia are trialing blockchain-based voting systems, potentially boosting voter participation and trust. The transparency and security provided by blockchain can enhance the integrity of elections, ensuring that every vote is accurately recorded and counted.

This technology can also increase voter confidence and participation, leading to more democratic and fair election processes. Implementing blockchain in voting systems eliminates the need for intermediaries and auditors to verify the vote’s integrity, speeding up vote counting and reducing costs. This system fosters a more inclusive democratic process, with easier access for remote or disabled voters. Voters can verify that their votes are accurately recorded and counted securely, providing greater confidence in electoral outcomes.

Challenges to Adoption

Scalability Issues

As blockchain networks grow, so does the challenge of handling increased user and transaction volumes without congestion. Popular blockchains like Bitcoin and Ethereum have faced scalability issues, resulting in slower transaction times and higher fees during high demand. Solutions like layer 2 protocols (e.g., Bitcoin’s Lightning Network) and Ethereum’s transition to a proof-of-stake consensus mechanism are being explored, but maintaining security and decentralization while scaling remains a complex task. Scalability is a critical issue that must be addressed to ensure the widespread adoption of blockchain technology. Innovations and improvements in this area are essential to support the growing number of users and transactions on blockchain networks.

Researchers and developers are continuously searching for new methods to enhance blockchain throughput without compromising the system’s integrity. Technologies such as sharding, state channels, and off-chain computation are being considered to improve scalability while maintaining decentralized security protocols. These scalable solutions are crucial for ensuring blockchain networks can adapt to future demands and large-scale adoption without encountering performance bottlenecks and congestion issues.

Regulatory Uncertainty

The evolving regulatory landscape for blockchain and cryptocurrency creates uncertainty for businesses and investors. Different countries have varied approaches, ranging from supportive to restrictive stances on cryptocurrencies. For instance, the U.S. SEC considers some cryptocurrencies as securities requiring strict regulation, while El Salvador has adopted Bitcoin as legal tender. This inconsistency in regulations can hamper innovation and complicate cross-border operations. Regulatory uncertainty is a significant barrier to the widespread adoption of blockchain technology and cryptocurrencies, as businesses and investors need clarity to ensure compliance and mitigate risks.

Authorities worldwide are engaged in creating more cohesive regulations to balance innovation with consumer protection and financial stability. Regulatory frameworks need to be harmonized to provide clarity and legal certainty for the industry. Countries must collaborate on international standards to address issues like money laundering, terrorist financing, and fraud while fostering a supportive environment for technological advancements. By developing clear and consistent regulations, governments can reduce the risks associated with blockchain and cryptocurrency investments and enhance the industry’s legitimacy and sustainability.

Security Concerns

While blockchain is inherently secure, vulnerabilities exist that can be exploited by malicious actors. Issues within smart contracts and the susceptibility of cryptocurrency exchanges to high-profile hacks pose significant threats. Companies are investing in advanced security technologies, such as multi-signature wallets and decentralized exchanges, to enhance security, but the risk of cyberattacks remains prominent. Ensuring the security of blockchain networks and cryptocurrency ecosystems is paramount for building trust and encouraging broader adoption.

Continuous advancements in cybersecurity practices, threat detection, and response strategies are critical to mitigating these risks. Decentralized applications need thorough security audits and smart contract verifications to locate and fix vulnerabilities before they are exploited. Moreover, users should be educated about proper security practices, such as safeguarding private keys and utilizing hardware wallets. A collective effort from the community, regulators, and security experts is required to provide a resilient defense against evolving cyber threats and build a trustworthy digital infrastructure.

Energy Consumption

Blockchain networks, particularly those using proof-of-work (PoW) consensus mechanisms like Bitcoin, require significant computational power, leading to high energy consumption. This raises environmental sustainability concerns. Efforts are underway to develop more energy-efficient mechanisms like proof-of-stake (PoS), which Ethereum has adopted, but ongoing sustainability issues may challenge the long-term viability of blockchain. The environmental impact of blockchain technology is a growing concern, and addressing energy consumption is crucial to ensure its sustainable integration into various sectors.

Innovations such as carbon offsetting, green energy adoption, and renewable resources can help mitigate the environmental impact of blockchain networks. Further advancements in consensus mechanisms and the optimization of computational processes can significantly reduce the energy footprint of blockchain operations. Collaboration between blockchain developers and environmental researchers can lead to the creation of eco-friendly blockchain technologies, enabling their sustainable use without compromising the environment.

Lack of Awareness and Understanding

A considerable segment of the general public still views blockchain and cryptocurrency as complex and risky. This lack of understanding and awareness can slow adoption rates. Educational efforts and developing user-friendly platforms are necessary to enhance public acceptance and utilization. Many people are unaware of the potential benefits and practical applications of blockchain technology and cryptocurrencies, leading to hesitation and reluctance to embrace these innovations.

Educational initiatives, public campaigns, and comprehensive resources can demystify blockchain technology and cryptocurrencies, making them more approachable for the average person. Incorporating blockchain education into academic curricula and professional training programs can foster a workforce capable of navigating and innovating within this space. Additionally, creating intuitive platforms and applications that simplify user experiences can bridge the gap between complex technology and everyday use, encouraging widespread adoption and fostering public trust.

Future Prospects and Innovations

The future of blockchain and cryptocurrency appears promising, with continuous advancements aimed at addressing current challenges and enhancing industry integration. Innovations such as decentralized finance (DeFi) and non-fungible tokens (NFTs) are expanding use cases, attracting new users and investors. As technology continues to evolve, its role in shaping the future of various industries will likely grow. DeFi platforms disrupt traditional financial systems by offering decentralized alternatives for banking, borrowing, lending, and trading, democratizing access to financial services.

NFTs revolutionize ownership and the distribution of digital assets, enabling new ways for artists, creators, and collectors to interact with the digital economy. As these technologies evolve, they are expected to introduce innovative solutions that address scalability, security, and regulatory challenges. Blockchain’s integration with emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and quantum computing could further expand its potential applications. This convergence of technologies can enable more intelligent, efficient, and secure decentralized systems, fostering a new era of innovation.

Conclusion

Blockchain and cryptocurrency demonstrated significant potential in transforming industries and solving longstanding problems, from financial services to healthcare. While challenges existed, such as scalability, regulatory uncertainty, security issues, and energy consumption, efforts were made to address these obstacles. With ongoing developments and innovations, blockchain and cryptocurrency were poised to remain vital components of the future digital economy, driving change and creating new opportunities across various sectors. This analysis captured the intricate details and diverse perspectives within the blockchain and cryptocurrency landscape, providing a cohesive narrative that reflected their transformative impact and the challenges to their broader adoption. The summary was detailed, logically structured, and maintained objectivity, offering a comprehensive understanding of the topic’s nuances and potential.