In an age where technology is woven into the very fabric of our holiday traditions, the line between festive convenience and digital danger is becoming increasingly blurred. We sit down with Oscar Vail, a technology expert whose work at the forefront of AI and robotics gives him a unique perspective on the evolving landscape of cyber threats. He joins us to discuss the hidden risks lurking in our digital Christmas celebrations, from the deceptive charm of AI-generated greeting cards and shopping assistants to the classic-but-effective scams that prey on our holiday spirit and the vulnerabilities we overlook in our quest for connectivity.

You call Christmas e-cards a ‘perfect Trojan horse,’ particularly with AI creating family greetings. Could you elaborate on how these cards facilitate data misuse like deepfakes and walk us through the steps to verify an e-card company’s reputation before entrusting it with our personal photos?

It’s a brilliant and insidious tactic. You’re swept up in the holiday fun, you see an app that can turn your family into dancing elves, and you think, “This is hilarious!” So you upload a great, high-resolution photo. What you’ve just done is hand over a perfect biometric scan to a company you know nothing about. This data is a goldmine for creating deepfakes; it’s not just about a funny video, it’s about creating a digital puppet of you or your children that can be used for much more sinister purposes. To protect yourself, you have to do your due diligence. Before uploading anything, search for the company’s privacy policy. Look for explicit language about how they use and store your data. Are they selling it? Are they using it to train other AIs? Also, search for independent reviews from security experts, not just app store ratings. And as a personal rule, I always use a pseudonym and a separate, non-primary email address for these kinds of services to minimize the connection to my real identity.

The article warns against blindly trusting AI assistants for holiday shopping. What are some red flags that an AI-generated shopping link might be malicious, and could you provide a step-by-step guide for safely vetting these suggestions before we click or share any financial information?

The primary red flag is a sense of urgency or a deal that seems disconnected from the official market. An AI might suggest a link to a sold-out item that a website magically has in stock at a huge discount. That’s a classic lure. The link itself might also look suspicious—maybe it’s a shortened URL or a domain that’s a slight misspelling of a famous brand. My step-by-step guide for safety is simple but effective. First, never click the link directly from the chatbot. Instead, highlight and copy the product name it suggests. Second, open a new, clean browser window and use a trusted search engine to search for that product and the supposed retailer. Third, find the retailer’s official website through the search results and navigate to the product yourself. This ensures you’re on their legitimate site. Finally, never, ever grant a chatbot or an AI assistant direct access to your financial accounts or credit card information. It’s a gateway you should always control manually.

You advise that if a deal seems too good to be true, it’s likely a scam. Beyond obvious typos, what are the more subtle signs of a scam website or a data-hungry shopping app? Please share a real-world example of how such a scam typically unfolds for an unsuspecting shopper.

The subtle signs are often in the architecture of the website and its digital footprint. Look for a lack of contact information, like a physical address or a phone number. Check for a very recent domain registration date; a site created just last month claiming to be a major retailer is a huge red flag. A common scenario I’ve seen involves a social media ad for a luxury item, say a high-end coat, for 80% off. The ad leads to a beautifully designed website that looks completely legitimate. The shopper, feeling the thrill of the find, enters their name, address, and credit card details. The moment they hit “purchase,” their data is stolen. They might receive a cheap knockoff weeks later, or nothing at all, but the real damage is done. Their financial information is now being sold on the dark web. It’s a gut-wrenching experience that starts with the emotional high of a bargain and ends in the cold reality of fraud. This is why it’s also crucial to periodically review your phone’s app permissions; many shopping apps track your behavior to target you with these “perfect” scams.

You compare using public Wi-Fi without a VPN to leaving your front door open. Can you explain the specific techniques hackers use on these networks to steal financial credentials, and how exactly does a VPN create a secure shield to protect a user’s sensitive data?

Imagine you’re in a busy airport, scrambling to buy a last-minute gift online. You connect to “Airport_Free_WiFi.” What you may not realize is that a hacker nearby has set up a nearly identical network called “Airport_Free_Wi-Fi.” Your device connects automatically, and now everything you send over that network—your email password, your credit card number, your private messages—is passing directly through the hacker’s laptop. This is a classic “man-in-the-middle” attack, and it’s terrifyingly simple to execute. They can see all your unencrypted data as plain text. A VPN, or Virtual Private Network, completely neutralizes this threat. It creates an encrypted, digital tunnel from your device to a secure server. Before any data leaves your phone or laptop, it’s scrambled into unreadable code. So even if that hacker intercepts your traffic, all they see is gibberish. It’s the digital equivalent of sending your mail in a locked, steel box instead of on an open postcard.

What is your forecast for how scammers will leverage new technologies, like more advanced AI, to create even more sophisticated holiday-themed threats next year, and what should consumers start preparing for now?

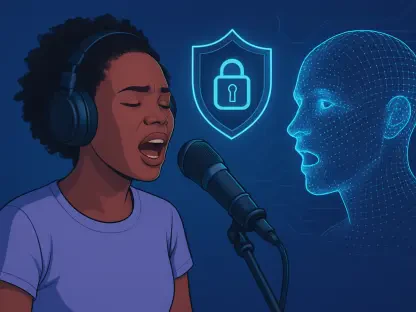

My forecast is that the line between reality and AI-generated fiction will become almost indistinguishable in scams. Next year, I expect we’ll see hyper-personalized phishing attacks on a massive scale. Imagine receiving a video e-card from a loved one, where their AI-cloned voice and face tell you about a fantastic, exclusive holiday deal and give you a specific link. It will feel incredibly real and trustworthy. We will also see AI-driven scam chatbots that can conduct long, convincing conversations, perfectly mimicking the customer service agents of major retailers to trick you into revealing sensitive information. The best preparation is to cultivate a “zero-trust” mindset, even with familiar contacts. Verbally confirm any unusual financial requests or too-good-to-be-true offers with your loved ones through a separate, secure channel, like a direct phone call. Start practicing strong digital hygiene now: use unique, complex passwords for every account and enable multi-factor authentication everywhere you can. The threats will always evolve, so our vigilance must evolve with them.