In an era where digital solutions are reshaping the financial landscape, Ecobank Nigeria has emerged as a frontrunner in transforming how banking services are accessed and experienced across the country. With a rapidly growing population relying on mobile technology for everyday transactions, the demand for seamless, secure, and accessible banking platforms has never been higher. Ecobank has responded to this need with a newly upgraded mobile banking app that promises to redefine user convenience and financial inclusion. This strategic update not only caters to tech-savvy urban dwellers but also reaches into semi-urban regions where traditional banking infrastructure remains limited. By prioritizing a mobile-first approach, the bank is tapping into the pulse of Nigeria’s evolving retail banking sector, setting a benchmark for innovation. This development sparks curiosity about how such advancements can bridge gaps in financial access while navigating the challenges of security and user trust in a competitive market.

Digital Transformation Through Innovative Features

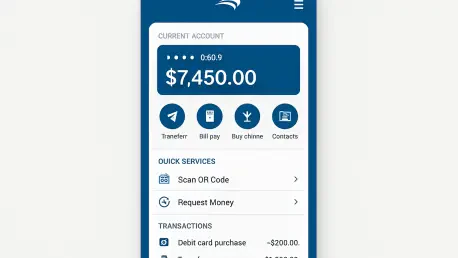

Ecobank Nigeria’s latest mobile banking app upgrade introduces a suite of cutting-edge features designed to enhance user experience and streamline financial transactions. Available on both Google Play and the Apple App Store, the app boasts a redesigned interface that emphasizes speed and simplicity, catering to the modern consumer’s need for efficiency. Key enhancements include advanced facial recognition for secure logins, cardless onboarding for new users, and real-time account management tools that allow customers to handle their finances without stepping into a branch. From instant transfers and bill payments to airtime purchases and QR code transactions, the app consolidates essential services into a unified dashboard. Additionally, live foreign exchange rates support cross-border dealings, making it a versatile tool for a diverse user base. This comprehensive overhaul reflects a clear intent to meet evolving consumer expectations and position the bank as a leader in digital convenience within Nigeria’s financial ecosystem.

Beyond the technical upgrades, the focus on accessibility sets this app apart in a market hungry for inclusive solutions. The ability to open or reactivate dormant accounts remotely eliminates the need for physical branch visits, a significant barrier for many potential customers. Card management features, such as activation, PIN resets, and blocking, empower users with greater control over their financial tools. This is particularly impactful for individuals in remote or semi-urban areas where banking infrastructure is sparse. By integrating these self-service options, Ecobank is not just modernizing banking but also democratizing access to financial services. The emphasis on user-centric design ensures that even those unfamiliar with digital platforms can navigate the app with ease, fostering a sense of empowerment. This move underscores a broader vision to align with Nigeria’s accelerating fintech adoption, where mobile apps are fast becoming the primary gateway to banking for millions of citizens.

Driving Financial Inclusion in Underserved Regions

One of the most compelling aspects of Ecobank Nigeria’s mobile banking upgrade is its commitment to financial inclusion, particularly in regions where traditional banking remains out of reach. In semi-urban and rural areas, the scarcity of physical branches often leaves communities disconnected from formal financial systems. The app’s cardless onboarding process, coupled with facial verification technology, lowers entry barriers by allowing individuals with limited documentation to access banking services. This initiative targets first-time users who might otherwise remain excluded due to logistical or bureaucratic challenges. By leveraging mobile technology, Ecobank is creating pathways for these underserved populations to participate in the formal economy, save securely, and access credit. Such efforts align with national goals to expand financial access and highlight the transformative potential of digital platforms in bridging socioeconomic gaps.

Moreover, the broader implications of this focus on inclusion resonate across Nigeria’s diverse demographic landscape. As mobile penetration continues to rise, apps like Ecobank’s serve as vital tools for integrating unbanked populations into the financial mainstream. The simplicity of the app’s interface ensures that even those with minimal digital literacy can engage with banking services, fostering trust and adoption. This is not merely about providing access but also about building a sustainable ecosystem where financial empowerment drives economic growth. The bank’s strategy mirrors a sector-wide shift toward mobile-first solutions, recognizing that smartphones are often the only point of contact for many Nigerians with the digital world. By prioritizing these communities, Ecobank is not only expanding its customer base but also contributing to a more inclusive financial future, setting an example for other institutions to follow in addressing systemic inequities through technology.

Competing in a Mobile-First Banking Landscape

In Nigeria’s fiercely competitive banking sector, Ecobank’s app upgrade is a calculated response to the industry’s rapid pivot toward digital ecosystems. Top-tier banks like Access Bank, GTCO, and UBA have also rolled out enhanced digital platforms with features such as biometric logins and self-service tools, reflecting a market driven by consumer demand for convenience and efficiency. Ecobank stands out by integrating robust security measures, including biometric verification and encryption protocols, to safeguard users against the rising threat of mobile fraud and identity theft. These protections are crucial in a landscape where tighter margins on traditional services push banks to innovate while maintaining customer trust. The race to dominate the mobile banking space is not just about technology but also about delivering a seamless, secure experience that keeps pace with evolving preferences and expectations.

Equally important is the bank’s recognition that technological advancements alone are not enough to secure market leadership. Industry analysts stress that user education and prompt fraud resolution are vital to sustaining confidence in digital platforms. Ecobank’s commitment to ongoing customer support and transparent communication will likely play a pivotal role in the app’s long-term success. As mobile banking becomes the norm, the ability to address user concerns swiftly and effectively sets a benchmark for reliability. This competitive environment pushes banks to continuously refine their offerings, ensuring that innovations translate into tangible benefits for customers. Ecobank’s strategic focus on balancing innovation with trust-building measures positions it well to navigate the challenges of a crowded market, reinforcing its relevance in a sector where adaptability is key to retaining loyalty and attracting new users.

Reflecting on a Digital Banking Milestone

Looking back, Ecobank Nigeria’s rollout of an upgraded mobile banking app marked a significant step in redefining financial access and user experience across the nation. The integration of innovative features and a strong emphasis on security addressed pressing consumer needs while navigating the complexities of a competitive market. Efforts to extend services to underserved regions through cardless onboarding and user-friendly design demonstrated a commitment to inclusivity that resonated deeply with diverse populations. As the bank tackled challenges like mobile fraud and onboarding friction, the focus remained on fostering trust through education and support. Moving forward, the success of such initiatives suggests a path where sustained collaboration between banks, regulators, and technology providers could further enhance digital ecosystems. Exploring scalable solutions to deepen financial inclusion and strengthen cybersecurity will be critical next steps in ensuring that mobile banking continues to empower communities and drive economic progress.