Quantum computing is no longer just a concept reserved for theoretical physics. Its imminent entry into various professional fields, including auditing, promises to be revolutionary. As quantum computers move from research labs into real-world applications, the auditing profession stands on the cusp of a transformation that could redefine its practices. This article explores how quantum computing is set to reshape the auditing landscape by highlighting both the opportunities and challenges that auditors will face in the coming years.

Understanding Quantum Computing

The Basics of Quantum Computing

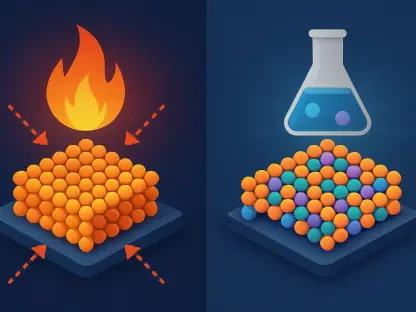

Quantum computing represents a significant leap from traditional computing. Unlike classical computers that use bits as the smallest unit of data, quantum computers use qubits. Qubits exploit quantum mechanics principles, such as superposition and entanglement, enabling them to process complex information at unprecedented speeds. These principles allow quantum computers to solve problems in minutes that would take classical computers millennia to compute, making them a game-changing technology for data-intensive fields like auditing.

Superposition is the ability of a quantum bit to exist in multiple states simultaneously, as opposed to the binary state of 0 or 1 in classical computing. This makes it possible for quantum computers to perform many calculations at once. Entanglement, another principle of quantum mechanics, allows qubits that are entangled to remain interconnected across distances. Changes to one qubit will instantaneously affect the other, regardless of the distance between them. This fundamental difference from traditional computing methods offers a potential paradigm shift in how data is analyzed and processed, particularly in auditing.

Implications for Auditors’ Skillsets

To leverage the benefits of quantum computing, auditors must first understand its principles. This requires an educational overhaul, integrating quantum mechanics basics into accounting curriculums and professional training. Auditors will need to grasp the complexities of superposition, where a qubit can exist in multiple states simultaneously, and entanglement, which allows qubits to be interconnected across distances. Understanding these principles will be instrumental in applying quantum computing effectively in audit processes.

Current educational programs in accounting and auditing rarely cover advanced topics like quantum mechanics, leaving a significant knowledge gap. To fill this gap, audit professionals will need to engage in continuous learning and professional development. Educational institutions and professional bodies will need to offer specialized courses and certifications focusing on the fundamentals of quantum computing and its applications in auditing. By doing so, they ensure that auditors are not only aware of the technology but are also equipped to use it efficiently to enhance their practice.

Revolutionizing Data Analysis

Enhanced Computational Capabilities

Quantum computing’s superiority in handling vast datasets presents a game-changing opportunity for auditors. Traditional computers often struggle with the extensive data involved in complex audits, leading to time-consuming and sometimes less accurate results. Quantum computers can process multiple variables simultaneously, providing faster and more accurate data analysis. This capability will fundamentally enhance activities like risk assessment and fraud detection, making audits more thorough and timely.

The ability to handle and analyze large datasets quickly and accurately means that quantum computing can significantly reduce the time required for audits. This increase in efficiency allows auditors to focus on more strategic aspects of their work, such as interpreting findings and providing more meaningful insights. Moreover, the speed and accuracy of quantum computing will enable auditors to identify patterns and anomalies that might be missed with traditional computing methods, thereby increasing the reliability of audit outcomes.

Innovative Audit Techniques

With quantum computing, new audit techniques become possible. For instance, auditors could use quantum simulations to model financial systems, predicting various risk scenarios more accurately. These advanced simulations can reveal insights that were previously unattainable, offering deeper assurance of financial integrity. The ability to run such sophisticated models will set a new standard in audit quality and reliability.

Quantum simulations can also help auditors in stress testing financial models under various hypothetical conditions. This capability allows auditors to preemptively identify weaknesses and vulnerabilities within financial systems, providing their clients with valuable recommendations to mitigate potential risks. By leveraging such innovative techniques, the auditing profession can move beyond traditional practices and offer more comprehensive, future-focused services. As a result, quantum computing will not only enhance the technical aspects of auditing but also elevate the strategic value auditors bring to their clients.

Cybersecurity Concerns

Quantum Threats to Encryption

Quantum computing’s power isn’t without its risks, especially concerning cybersecurity. One significant threat lies in its ability to break public-key encryption, a cornerstone of current data protection practices. While fully functional quantum computers capable of this are not yet commonplace, their potential emergence poses a serious risk. Auditors must stay ahead of these developments to ensure data integrity and security are upheld in their audits.

The encryption methods that currently secure most digital communications and transactions could become obsolete with the advent of quantum computing. Public-key encryption relies on the difficulty of factoring large prime numbers, a task that classical computers find challenging but quantum computers could perform with relative ease. This breakthrough could compromise everything from email communications to financial transactions and stored data. Therefore, auditors need to work closely with cybersecurity experts to develop quantum-resistant encryption methods and adapt existing protocols to safeguard sensitive information effectively.

Maintaining Data Integrity

Adaptations in cybersecurity measures will be crucial. Auditors will need to collaborate closely with IT and cybersecurity experts to develop quantum-resistant encryption methods. This involves staying informed about emerging threats and proactively implementing new security protocols. Ensuring data remains secure from quantum threats will be paramount in maintaining trust in audit processes.

Developing quantum-resistant encryption is not the only challenge. Auditors will also need to ensure that the entire audit process, from data collection to reporting, is safeguarded against potential quantum threats. This includes upgrading existing systems and protocols to incorporate new security measures and continuously monitoring for vulnerabilities. By taking a proactive approach to cybersecurity, auditors can protect the integrity of their work and maintain the confidence of their clients in an increasingly digital and interconnected world.

Proactive Integration of Quantum Computing

Educational Ventures

The auditing profession must take a proactive stance in integrating quantum computing. This starts with comprehensive educational programs tailored to bridge the knowledge gap. Professional bodies and institutions must offer courses and certifications focusing on quantum computations’ fundamentals and applications in auditing. By fostering a culture of continuous learning, auditors can stay equipped to deal with evolving technologies.

Educational initiatives should not be limited to new professionals entering the field but should also include ongoing training for experienced auditors. Workshops, seminars, and online courses can provide audit professionals with the necessary knowledge and skills to understand and utilize quantum computing. Additionally, collaborations with technology companies and academic institutions can offer valuable insights and resources. Such partnerships allow auditors to stay at the forefront of technological advancements and apply quantum computing in innovative ways to enhance their practice.

Strategic Implementation

Beyond education, a strategic approach to incorporating quantum computing into audit frameworks is essential. Auditors should experiment with pilot projects to understand how quantum computing can be practically applied. This phased integration allows for adjustments and improvements, ensuring seamless adoption when the technology becomes more mainstream. A well-planned strategy will enable auditors to harness the full potential of quantum computing while mitigating associated risks.

Strategic implementation also involves setting clear objectives and benchmarks to measure the success of quantum computing applications within audit processes. Auditors should identify specific areas where quantum computing can add the most value and create detailed plans for its integration. Pilot projects can serve as test beds for new techniques and technologies, allowing auditors to refine their approaches before full-scale deployment. By taking a methodical and measured approach, auditors can ensure that quantum computing enhances their practice without disrupting their core operations.

Emerging Role of Auditors

Becoming Technology Advocates

As quantum computing becomes more integrated, auditors will increasingly take on the role of technology advocates. Their unique position allows them to champion best practices in adopting and leveraging new technologies within organizations. By promoting a forward-thinking mindset, auditors can help shape an adaptable and resilient auditing landscape, ready to face future technological advancements.

Auditors can serve as a critical link between technology and business practices. By understanding and advocating for quantum computing, they can guide organizations in making informed decisions about technology adoption. This advocacy role not only enhances the value auditors bring to their clients but also positions them as thought leaders in the field. Their insights and recommendations can help organizations navigate the complexities of quantum computing, ensuring they remain competitive and innovative in an ever-evolving technological landscape.

Continuous Evolution

Quantum computing has evolved beyond being merely a concept confined to theoretical physics; it’s gearing up for tangible impact across various professional fields, including auditing. As quantum computers transition from research facilities to practical applications, the auditing sector is poised on the brink of significant transformation. The integration of quantum computing into auditing could revolutionize how audits are conducted, promising greater accuracy and efficiency. By leveraging the immense computational power of quantum machines, auditors can process vast datasets at unprecedented speeds, uncovering patterns and anomalies that traditional computers might miss. However, this shift also brings challenges. Auditors must adapt to new technologies, re-skilling and up-skilling to stay relevant in a quantum future. Furthermore, as quantum computing grows more prevalent, ethical considerations and data security measures will become increasingly crucial. This article delves into how quantum computing is set to revamp the auditing landscape, examining both the enormous opportunities for advancement and the hurdles auditors will need to overcome in the years ahead.