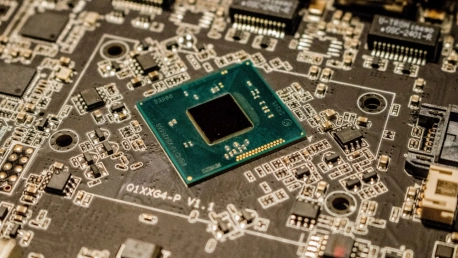

In the wake of the Russia-Ukraine conflict, a wide range of industries around the globe are bracing for big problems. After already breaking supply chains and halting car production, the crisis in Ukraine also has the potential to worsen the global chip crisis, as some crucial raw materials are sourced from the region.

The war has the potential to worsen the global chip crisis

In the long term, the crisis in Ukraine has the potential to worsen the chip crisis. A grim estimate by US Commerce Secretary Gina Raimondo notes the chip inventory held by manufacturers has plummeted to an average of only five days’ supply, down from 2019 levels of 40 days. This means that if something disrupts semiconductor production for even just a few weeks, it has the potential to shut down factories in the US and beyond.

“This tells you how fragile this supply chain is,” she said. “Five days of inventory, no room for error.”

Chipmaker Taiwan Semiconductor Manufacturing Company (TSM), which accounts for 50% of the global chip manufacturing market, has said it will comply with sanctions against Russia. Taiwan is home to the world’s largest contract chipmaker and Asia’s most valuable listed company, TSMC.

But Russia accounts for 42% of global exports of palladium, 70% of neon, 40% of nitrogen, and 30% of xenon, which are essential ingredients for semiconductor production. If Moscow retaliates by stopping exports, the global semiconductor industry will suffer. Experts estimate that Taiwan has diversified its sources of supply for these ingredients and has already stockpiled them.

According to research company Techcet, the market for high-purity inert gases used in the electronics industry is expected to exceed $7 billion by 2022, driven mainly by the expansion of silicon chip factories. There are other sources for raw materials than Russia and Ukraine. However, in a global market, if one supplier is locked in, other suppliers have the opportunity to raise prices. The price of palladium has already exceeded $3000 per ounce, the highest price ever. The cost of materials is not automatically passed on to consumers, but if the shortage is long enough and severe enough that automakers decide or are forced to produce fewer vehicles, their prices will rise.

On March 8, The London Metal Exchange suspended trading in its nickel market after an unprecedented price spike left brokers struggling to pay margin calls against unprofitable short positions, in a massive squeeze that has embroiled the largest nickel producer and a major Chinese bank, Bloomberg reports. Other base metals also surged, with copper and aluminum touching record highs before gains ebbed.

Nickel, used in stainless steel and lithium-ion batteries, added more than $17,000 to trade at an almost 15-year high above $40,000 a ton, in the biggest-ever daily dollar gain in the 35-year history of the contract.

Nickel’s surge was just one part of a chaotic rise in prices across energy and commodities. Copper and aluminum both rose to all-time highs in Asia and London trading, as soaring oil prices and fears of supply shocks rattled raw-materials markets amid Russia’s invasion of Ukraine.

European car plants affected by supply problems linked to war

Globalization of production, with some of it in the conflict region, is breaking supply chains and halting car production inside and outside Russia and Ukraine. Because of a shortage of parts from suppliers in Ukraine, including Fujikura, Nexans, and Leoni, which produce essential wiring harnesses for German cars, the production of Audi models (A4, A5, A6, and A7) is suspended. Audi has also imposed an order freeze for its hybrid models due to the production disruptions.

Porsche is also suspending production of the Macan, Panamera, while the BMW Group is halting production next week at its Munich and Dingolfing plants, both in Germany, and production at the group’s Mini plant in Oxford, England. Mercedes-Benz expects to cut production at some of its European plants as supplies of parts produced in Ukraine run out.

Ukraine is home to over 20 global automotive companies such as Bosch, Fujikura, Eurocar, Prettl, Aptiv, and has more than 30 automotive plants. The Ukrainian automotive industry employs over 60,000 people. Although most of the companies are located near the western border with Hungary, Slovakia, and Poland, still outside the zones of military operations, the conflict has already disrupted production and supply flows.

In recent months, the automotive industry has been hit hard by the global semiconductor shortage. Now, the Russia-Ukraine conflict has the potential to worsen the global chip crisis, experts estimating the car industry facing shortages and higher prices of raw materials.